dog insurance health choices that protect your budget and your best friend

Think big, decide small

I zoom out first: your goal is resilience. A plan that softens shocks, keeps care accessible, and prevents a single incident from rewriting your savings plan. Then I zoom in: what does your dog actually face this year, and what can your wallet tolerate in a bad week?

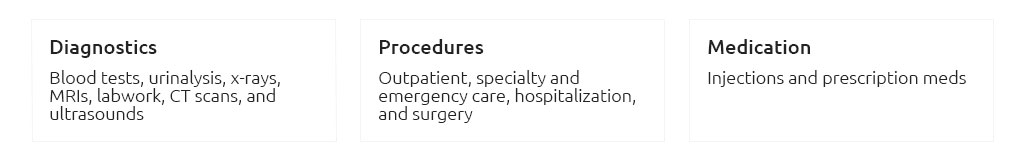

Quick comparison lens

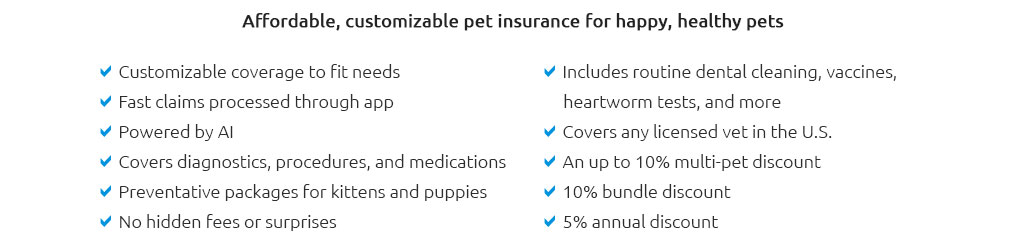

- Coverage scope: accident-only vs comprehensive (accident + illness). Add-ons for wellness can be helpful, but they often shift costs rather than create savings.

- Reimbursement style: percent of invoice (70 - 90%) is common. Benefit schedules cap payouts per condition; cheaper, but narrower.

- Deductible type: annual vs per-incident. Annual is simpler for chronic issues; per-incident can shine if problems are rare and unrelated.

- Limits: higher annual limits reduce tail risk; unlimited is calm-but-costly. Balance limit with your emergency fund.

- Waiting periods: days for accidents, longer for illnesses or knees/hips. Timing matters.

- Vet choice: most plans let you see any licensed vet. You pay, then claim.

- Exclusions: pre-existing conditions almost never covered. Read the fine lines around bilateral issues and hereditary risks.

Where savings usually hide

- Deductible vs premium trade: a higher deductible often saves more annually than you'll spend in a typical year, if your dog is low-risk.

- Reimbursement percent: dropping from 90% to 80% can cut premiums without hurting most bills; the difference matters on four-figure events.

- Pay annually to skip monthly fees, when cash flow allows.

- Multi-pet discounts are real, but compare base rates first.

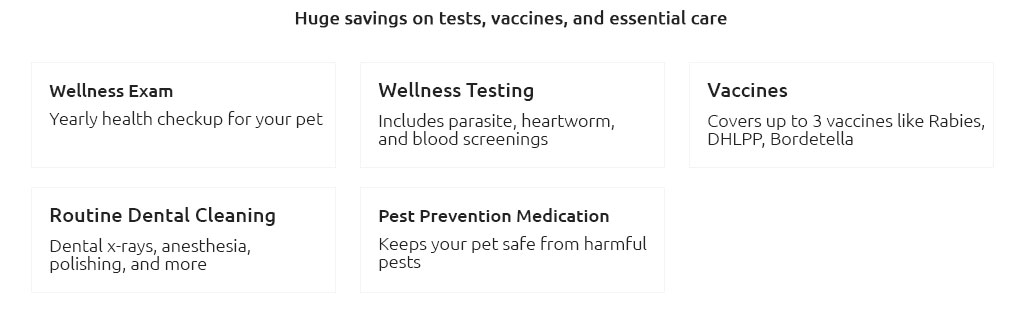

- Skip wellness if you already price-shop vaccines and routine care; consider it for predictable, high-cost checkups.

Pause.

Ask yourself: what's the largest surprise vet bill you could pay tomorrow, in cash, without stress? That number guides your deductible, limit, and whether insurance or a savings plan fits best.

A quiet, real-world moment

Last winter, Maya's Lab, Bruno, swallowed a sock. Midnight ER. X-rays, fluids, and monitoring: $1,850. With an $500 annual deductible and 80% reimbursement, her out-of-pocket was roughly $770. Not painless, but not catastrophic. Without coverage, that bill would have delayed his training classes for months and drained her holiday fund.

Use-case matchups

- Puppy explorers: higher accident risk; comprehensive with moderate deductible shines.

- Genetically prone breeds: look for no-condition caps, strong orthopedic terms, and clear hereditary coverage.

- Senior companions: premiums rise; consider higher deductible to keep monthly costs stable, or a disciplined savings buffer.

- Adventure dogs: check coverage for poison ingestion, foreign bodies, and after-hours ER; faster claims matter.

How to compare fast (apples to apples)

- List top 3 risks for your dog (injury, allergies, hip issues).

- Quote at the same deductible, limit, and reimbursement across 3 - 4 providers.

- Read exclusions for hips, knees, dental injury, and behavioral care.

- Simulate one expensive year: a $2,000 ER visit + a $1,200 allergy workup. Calculate true out-of-pocket.

- Check claims speed, direct pay options, and support hours.

What's rarely covered

- Pre-existing conditions or waiting-period incidents.

- Elective or cosmetic procedures.

- Breeding and pregnancy costs.

- Food and supplements without a prescription.

- Fees unrelated to medical necessity.

Numbers that matter to your wallet

All-in annual cost = premiums + expected out-of-pocket under a realistic scenario. Compare that to your emergency fund size. If coverage trims the worst-case spikes and the difference over DIY saving is small, that stability can be worth it.

Timing and enrollment

Starting earlier locks coverage before issues surface and avoids long orthopedic waiting periods. Switching plans resets pre-existing condition clocks - be careful.

If you choose to self-insure

Automate transfers to a dedicated pet-care fund, target a three- to five-thousand cushion, and ask your vet about cash pricing and payment plans. Pair with price-aware choices like generic meds and tele-triage when appropriate.

Bottom line

Good dog insurance health decisions balance risk, cash flow, and your dog's quirks. Compare on coverage first, price second. Aim for predictable costs and real savings, so the right care stays an easy yes.